Are you considering buying your dream home with a loan in 2024? Lots of people dream of owning a home, but for most, achieving this dream entails obtaining a Home Loan. While taking out a loan can help make owning a home possible, the idea of paying big monthly installments can be daunting.

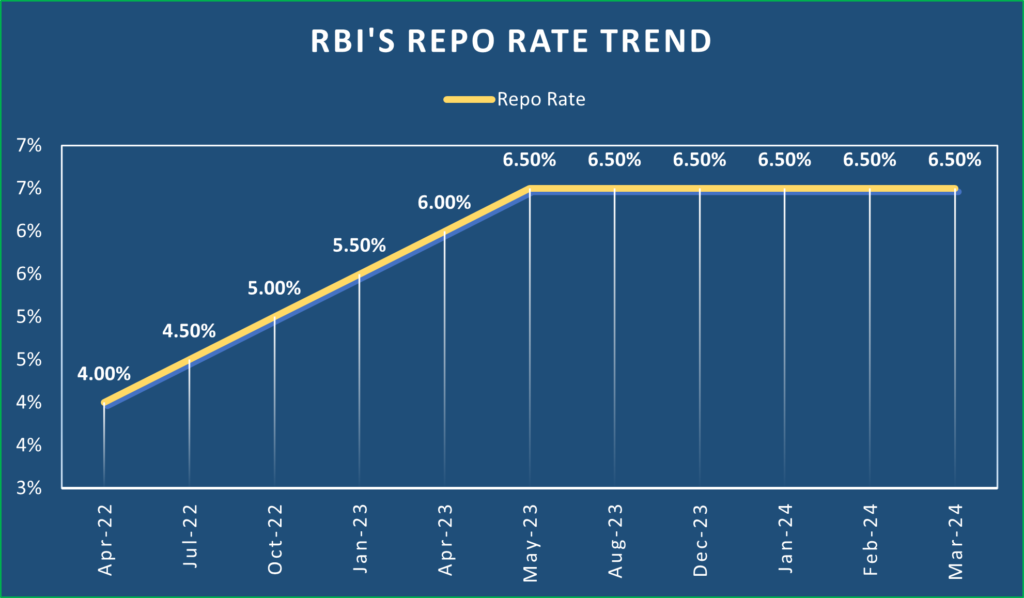

With the right set of strategies and the proper understanding of the unchanged repo rate in 2024, you can reduce your EMIs and achieve substantial savings over time. As the current repo rate is 6.50% on April 5, 2024 will significantly play a major role in influencing Home Loans. And it’s crucial to be informed in order to make optimal choices for your financial well-being. In this blog, we’ll delve into expert tips to help you lower your EMIs and maximize savings as you embark on the journey of homeownership in 2024.

Current Repo rate and its impact on your Home Loan EMI?

The Reserve Bank of India (RBI) has decided to keep the repo rates the same for the sixth time in a row at 6.5%. Repo rate means the interest rate at which the RBI lends money to other banks. This choice was made during the three-day RBI’s Monetary Policy Committee meeting that happened from (February 6 to 8). The RBI usually has six meetings in a year where it makes decisions about interest rates, how much money is available, the expected inflation rate, and other big economic factors.

Keeping the interest rates stable brings relief to people who already have loans and those who might want to borrow in the future. This stability is expected to encourage more people to buy homes and give developers more confidence to start new projects. The central bank’s decision to stay focused on gradually reducing its supportive stance is likely to help control inflation even more.

How can the Repo Rate affect your Home Loan?

1. Rate of Interest – The repo rate directly affects the interest rates that banks and financial institutions offer on home loans. If the central bank decreases the repo rate, banks usually lower their lending rates, including those for home loans. This decrease in interest rates can make it cheaper for homebuyers to borrow money, leading to lower monthly payments (EMIs).

2. Borrowing Cost – Fluctuations in the repo rate impact how much it costs banks to borrow money. If the central bank raises the repo rate, banks might increase their lending rates to ensure they make enough profit. As a result, people taking out home loans could end up with higher interest rates and monthly payments. On the other side, if the repo rate decreases, banks can borrow money more affordably, allowing them to provide home loans with more competitive interest rates.

3.Home Loans Demand – Changes in interest rates, which are influenced by shifts in the repo rate, can affect how many people want to take out home loans. When interest rates are low because the repo rate has gone down, borrowing money becomes more appealing, causing more people to want home loans. Conversely, if the repo rate goes up and interest rates rise, potential homebuyers might be put off, leading to fewer people wanting home loans.

4. Economic Conditions – The repo rate mirrors the monetary policy position of the central bank, which is frequently shaped by wider economic circumstances. For instance, in times of economic growth, the central bank might increase the repo rate to control inflationary pressures. Elevated repo rates can lead to increased interest rates on home loans, potentially dampening housing demand and inflation.

5. Investor’s Emotions – Fluctuations in the repo rate can impact how investors feel about the housing market. A decrease in the repo rate suggests a supportive monetary policy, which can increase investor confidence and stimulate demand for real estate investments. On the other hand, if the repo rate rises, it may diminish investor confidence, resulting in reduced investment in the housing market.

What Home Buyers should do in unchanged repo rate for Home Loan?

As the Repo Rate is remain unchanged, both new and existing home Buyers could take several steps in order to make the most out of the current RBI repo rate for Home Loan:

1.Revaluate your Home Loan – People who already have home loans should look over their loan details and see if there’s a chance to switch to better rates through refinancing. It’s a good idea to get in touch with their lender to ask about any possible advantages or choices they might have because the repo rates haven’t changed.

2.Compare Loan Options – Potential home buyers should carefully examine loan options from various lenders to guarantee they get the best rates and terms possible. Even though the repo rate remains the same, they can still bargain with lenders for improved deals depending on their creditworthiness and financial status.

3. Choosing Between Fixed and Floating Rates – Homebuyers should consider whether fixed or floating interest rates better meet their requirements. Fixed rates offer stability and safeguard against potential future rate increases, whereas floating rates may initially be lower but can change with market conditions.

4. Budget Wisely – Both current and potential homebuyers should thoroughly evaluate their affordability in light of the unchanged repo rates. They should guarantee that their monthly mortgage payments match their budget and long-term financial aspirations to prevent any financial stress.

5. Keep Updated – It’s crucial for homebuyers to stay informed about economic indicators and market trends that could impact future rate choices made by the RBI. This understanding can assist them in making timely decisions about their home loans.

How you can Plan your Home Loan?

In order to plan your Home Loan you need to have a good strategy that could reduce your Interest cost. Below is a tabular example to make you understand.

| Particulars | Tenure (in Years) reduces to | Principal repayment (Rs.) | Total Interest Payment (Rs.) | Total Payment (Rs.) | Savings with increase in EMI (Rs.) |

| Actual Tenure and Interest Cost | 25 | 75 lakh | 1.14 Crore | 1.89 Crore | – |

| 5% increase in EMI Every year | 13 | 75 lakh | 61.80 lakh | 1.37 Crore | 52 lakh |

| 7.5% increase in EMI Every year | 12 | 75 lakh | 53.71 lakh | 1.29 Crore | 60 lakh |

| 10% increase in EMI Every year | 10 | 75 lakh | 48.26 lakh | 1.23 Crore | 65 lakh |

FAQs

Q1. What is the current reverse repo rate?

Ans. The current Reverse Repo rate is 3.35%.

Q2. What is the meaning of reverse repo rate?

Ans. The reverse repo rate is the interest rate set by the RBI for commercial banks. In this scenario, banks deposit excess funds with the RBI at a favorable rate and earn interest on them.

Q3. Who decides the repo and reverse repo rate in India?

Ans. The Monetary Policy Committee (MPC) of the RBI determines both the repo and reverse repo rates.

Q4. When does the RBI increase the reverse repo rate?

Ans. When inflation is high, the RBI increases the reverse repo rate. This encourages banks to put more money with the RBI to earn better returns on their extra funds.