India’s credit and debt landscape is currently witnessing major regulatory shifts. With changes ranging from updated risk guidelines to new support measures for exporters and growing concerns about unsecured loans, these developments are poised to impact borrowers, companies, NBFCs, and investors alike.

In this Blog, we will provide a simplified, well-rounded breakdown of the latest updates and their practical implications with authentic data visualizations.

Recent Updates on Loans and Debt Management

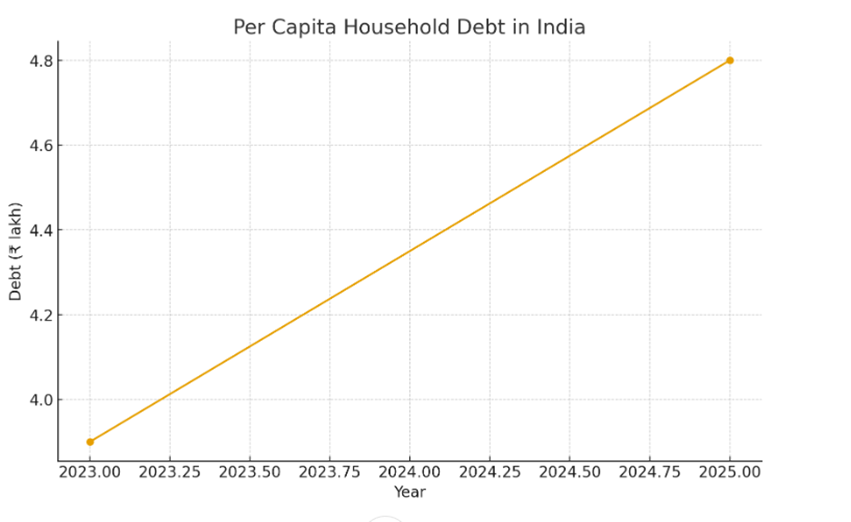

1. Growing Household Debt: What Borrowers Should Know

India’s household debt has been rising quickly, driven by the rapid expansion of personal loans, simplified access to credit, and the proliferation of digital lending platforms.

The RBI has issued multiple cautions to banks and NBFCs about the surge in unsecured lending — particularly the strong double-digit growth in credit cards and personal loans.

What this means:

Borrowers may face stricter loan eligibility checks, higher risk weights for lenders, and tighter regulations on unsecured credit going forward.

This Graph illustrates the rise in household debt driven by personal loans, credit card usage, and other unsecured credit. It clearly reinforces the RBI’s concerns about growing unsecured borrowing and increasing household leverage.

2. RBI’s Regulatory Shift: Stronger Emphasis on Credit Quality

The RBI is updating credit-risk guidelines and moving the financial sector toward an Expected Credit Loss (ECL) model. This approach requires banks to evaluate risks earlier and maintain stronger provisions for potential future defaults.

Who will feel the impact?

- Banks

- NBFCs

- Large corporate borrowers

- Retail borrowers with higher risk profiles

Possible outcomes include:

- Stricter and more selective loan approvals

- More disciplined and risk-aligned loan pricing

- Reduced credit stress in upcoming economic cycles

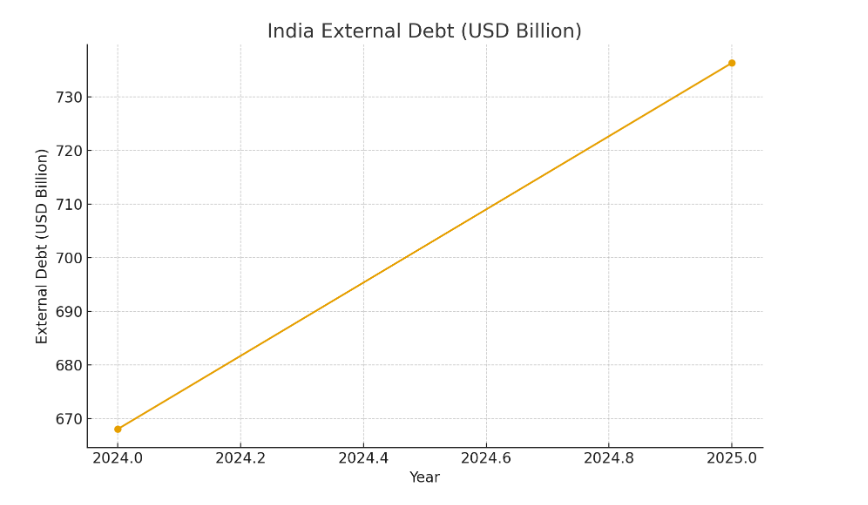

3. External Debt & Support Measures for Exporters

With global trade slowing, exporters have been dealing with delayed payments, softer demand, and higher borrowing costs.

To provide relief, the government has extended the repayment timelines for pre- and post-shipment credit, helping exporters manage their cash flows more comfortably.

What this means:

It reduces repayment stress for exporters during uncertain and volatile international trade conditions.

This Graph illustrates the increase in India’s external debt from 2024 to 2025, rising from roughly USD 668 billion to nearly USD 736 billion. It reflects a steady upward trend and signals a higher dependence on external borrowing over the year.Bottom of Form

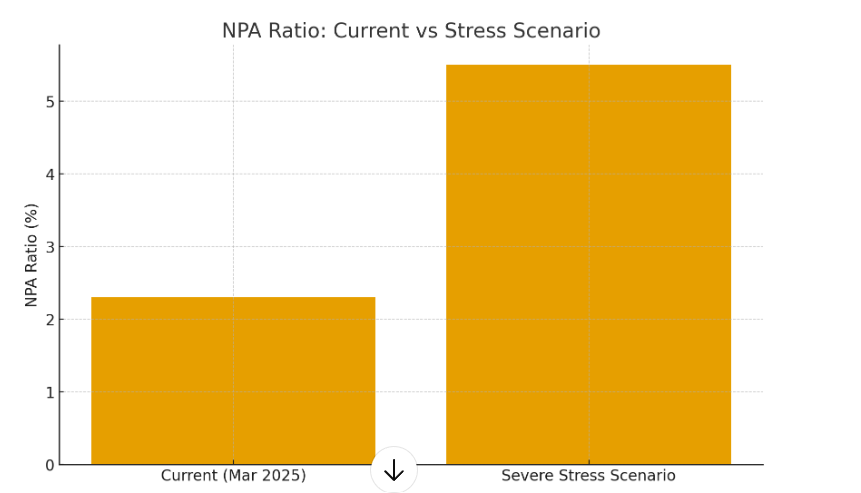

4. Declining NPAs Reflect a Strengthening Banking Sector

The health of India’s banking system has improved significantly. Gross NPAs have declined to nearly 2.3%, and even in a high-stress environment, any potential rise is expected to stay within controllable levels.

What this indicates:

- Improved loan underwriting

- More effective recovery processes

- Higher profitability for banks

Implication:

This creates greater capacity for banks to expand lending in 2025 and the years ahead.

This Graph highlights the decline in NPAs and shows potential outcomes under stress scenarios, supporting the insights shared on improving asset quality.

5. RBI Updates Credit Risk Guidelines

The RBI has introduced updated rules for how banks assess risk in corporate, MSME, and real estate lending. A key change is the shift to an Expected Credit Loss (ECL) system, which requires banks to build buffers in advance for potential loan losses rather than reacting after defaults occur.

Public comments are currently invited.

The new framework is slated to take effect from April 2027.

Impact:

Banks will be better protected against future stress, but borrowing costs for high-risk segments may increase. Sectors with greater volatility can expect tighter scrutiny.

6. Higher LTV for Loans Against Shares and Mutual Funds

The RBI has increased the loan-to-value ratio and raised the borrowing limit to ₹1 crore for individuals using shares or debt mutual funds as collateral.

Impact:

Investors get greater borrowing flexibility, but taking loans against market-linked assets can be riskier during market fluctuations.

7. Simpler Securitisation of Stressed Loans

The RBI is relaxing norms for securitising bad loans, allowing banks to:

- Package and sell stressed assets

- Transfer risk to specialised investors

- Release capital for fresh lending

Impact:

Banks can clean up their balance sheets more efficiently, the debt market becomes stronger, and investors gain new opportunities — though the risk shifts to those purchasing the assets.

8. Banks Moving from Government Bonds to More Lending

With deposits growing slowly, banks are reducing their holdings of government securities and redirecting more money toward loans.

Impact:

This boosts credit availability but increases risk on bank balance sheets as they shift from safe assets to higher-risk lending.

What These Changes Mean for Individual Borrowers

As risk rules tighten and concerns around unsecured lending grow, borrowers may face:

- More selective and cautious loan approvals

- Higher interest rates for those with weaker credit profiles

- Increased evaluation of repayment history and credit behaviour

- Greater sensitivity in variable interest rates to economic shifts

Why it matters:

Individuals will need to be more disciplined with credit usage, keep their credit scores healthy, and avoid taking on expensive or unnecessary unsecured loans to stay financially resilient.

Implications for Small Businesses & MSMEs

Small businesses and MSMEs may encounter slightly tighter lending conditions in the short term as banks transition to updated risk models. This may involve stricter documentation checks, more detailed financial scrutiny, and cautious loan approvals.

Over the long term, these changes bring meaningful benefits:

- Better transparency in how banks evaluate and price MSME loans, helping businesses understand and meet credit requirements.

- Cleaner and healthier bank balance sheets, which strengthen the financial system and support more stable lending.

- Higher availability of credit in the future, as improved compliance and risk management encourage banks to lend more confidently—making it crucial for MSMEs to maintain strong documentation, compliance, and credit discipline.

Global Economic Situation Behind these Changes

India’s revised lending and regulatory actions are being influenced by a difficult global economic backdrop. Global trade is losing momentum, inflation remains elevated in major markets, and interest rates in the US and Europe continue to swing, creating an unpredictable external environment. Geopolitical tensions and supply-chain disruptions are also driving instability in energy prices, commodities, and cross-border capital movement.

In response to these global pressures, the RBI is reinforcing India’s financial system to better absorb external shocks. By strengthening credit standards, refining risk-assessment models, and boosting the stability of banks and NBFCs, India is positioning its economy to remain steady even as international conditions grow more volatile.

Final Thoughts

India’s lending and debt ecosystem is moving toward a more robust and regulated structure as the RBI strengthens credit-risk norms, improves financial reporting, and offers targeted relief to stressed sectors such as exporters. Borrowers may encounter tighter scrutiny and more conservative lending, but these steps are designed to create stronger bank balance sheets and lower the risk of future defaults. The reforms also promote fairer loan pricing, prudent borrowing habits, and a more developed debt market. Together, these measures enhance India’s ability to withstand global volatility. Staying informed will enable individuals, businesses, and investors to make wiser financial choices.

Bottom of Form