The launch of GST 2.0 has sparked excitement across India, offering consumers and businesses a sense of relief and optimism. While retail inflation inched up slightly in August, experts believe it will remain under control in the coming months as the benefits of the recent GST rate cuts begin to take effect. Many analysts also expect the Reserve Bank of India (RBI) to keep interest rates unchanged in its upcoming policy review.

In September 2025, the Indian government announced a major rationalisation of GST rates—the most significant overhaul since the tax system was introduced in 2017. This move, backed by reports from Business Today and Mint, is seen as a strategic step to support price stability and ease the financial burden on households. With inflation staying low, the GST cuts aim not only to make products and services cheaper but also to boost the economy. This blog explains what the changes mean, their impact, and how they relate to India’s current inflation trends.

What Do the 2025 GST Rate Cuts Mean for You?

Starting from 22 September 2025, India’s GST system will be overhauled to make it simpler and more consumer-friendly. The earlier four-rate structure of 5%, 12%, 18%, and 28% has now been reduced to two main slabs—5% and 18%, while a new 40% slab has been created specifically for luxury and non-essential goods.

Everyday household essentials such as soaps, hair oils, and basic toiletries fall under the 5% category, ensuring affordability for consumers.

In addition, the GST on certain finished goods has been lowered to boost competitiveness and address the issue of “inverted duty” structures, particularly in sectors such as synthetic yarn, fibre, and select chemical inputs.

Recent Inflation and Economic Data

| Metric | Latest Data | Key Insights |

| Retail Inflation (CPI) – Aug 2025 | 2.07% YoY | Slightly higher than July’s 1.61%, but still very low. |

| Food Inflation – Aug 2025 | –0.69% | Negative for the second month, though the fall is less steep than in July. |

| Vegetable Inflation – Aug 2025 | –15.92% | Improvement compared to –20.69% in July. |

| Inflation Outlook for FY26 | 3.1% – 3.3% | Analysts expect average inflation in this range, supported by GST cuts. |

| Impact of GST Cuts on Inflation | Up to –1.1 percentage points | Reduction is possible if benefits are fully passed on to consumers. |

Inflation remains subdued and is likely to stay steady, while the recent GST cuts are expected to ease costs for both consumers and businesses.

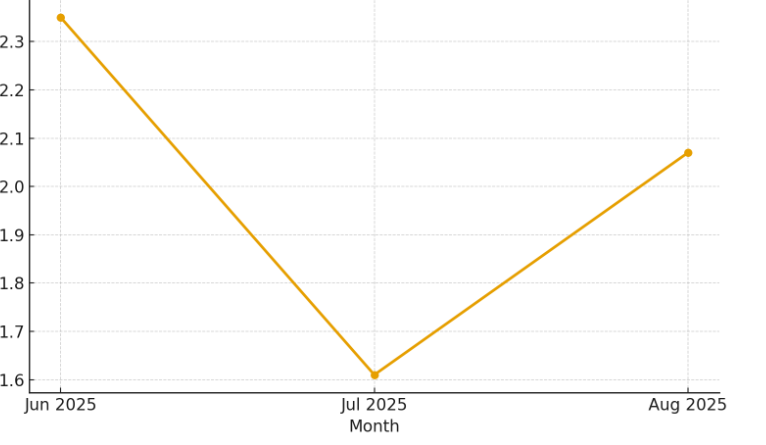

Retail Inflation Trends – ( June – August 2025)

Retail inflation fell to 1.61% in July 2025 and inched up to 2.07% in August, remaining well within the RBI’s comfort range.

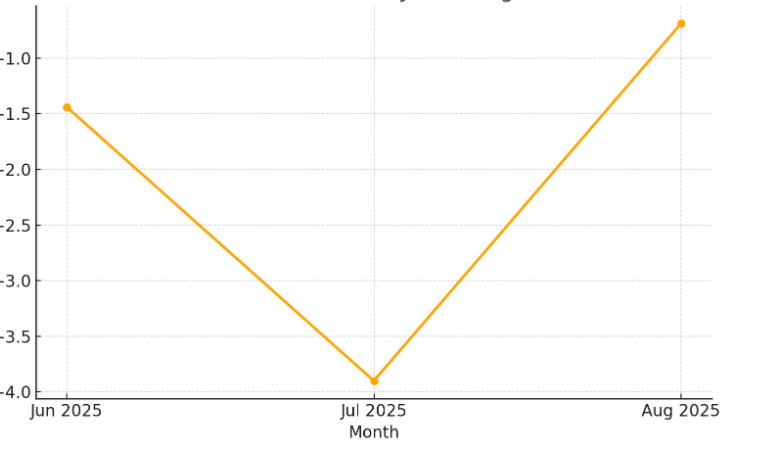

Food Inflation – Jun to Aug 2025

Food inflation remained in negative territory from June to August 2025, but the pace of decline has slowed.

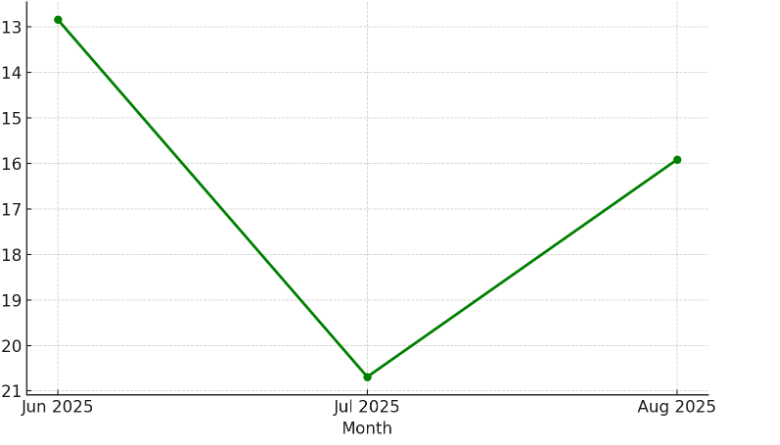

Vegetable Inflation – Jun to Aug 2025

Vegetable inflation stayed sharply negative, but improved from –20.69% in July to –15.92% in August 2025.

These trends indicate that India implemented GST rate cuts at a time when inflation was already low, providing policymakers with room to reduce taxes without triggering a surge in consumer prices.

What is the Impact of GST rate cuts in 2025?

1. Consumers

With GST rates reduced, many everyday essentials such as toiletries, soaps, and packaged food items will become cheaper. Consumers may see partial relief by late September, and they will likely experience the full benefits from October 2025 onwards.

2. Businesses & Key Sectors

Lower taxes on intermediate goods will help fix long-standing inverted duty structures, reducing input costs for manufacturers and MSMEs. This move is likely to benefit industries like FMCG, household goods, automobile components, and chemicals, which could see improved demand.

3. Government Revenues & Fiscal Health

Official estimates suggest the GST reform could result in a revenue loss of about ₹48,000 crore (US$5.5 billion). However, some analysts warn the impact could be closer to ₹1 lakh crore or more, depending on how effectively businesses pass the rate cuts on to consumers.

4. Inflation & Price Stability

Since headline inflation was already low at 2.07% in August 2025, the GST cuts are unlikely to spark a price surge. Instead, they are expected to either keep inflation stable or push it lower. Supported by falling food prices and a favorable base effect, analysts project the reforms could reduce inflation by 0.5 to 0.9 percentage points over the next year.

How Do GST Rate Cuts Help Control Retail Inflation?

Direct Impact: Lowering GST on widely used goods can reduce the final prices for consumers—provided manufacturers and retailers pass on the benefits instead of keeping them.

Indirect Impact: Reduced GST rates ease costs along the supply chain, from inputs to transport and packaging. With fewer cascading taxes, overall price pressures become more moderate.

Behavioral Effect: As the tax burden falls, consumer spending may rise, but in a steady way that avoids sudden demand spikes, helping keep inflation in check.

When Will the Benefits of GST Rate Cuts Be Visible?

Though the new GST rates come into force on September 22, 2025, most experts agree that the real impact will be visible from October onwards.

- Gradual Relief for Consumers

- According to Madan Sabnavis, Chief Economist at Bank of Baroda, price reductions on FMCG and household products (around 2.5%) will be partially noticeable in September but more clearly reflected from October.

- He expects inflation to average 3.1% in FY26, in line with the RBI’s forecast.

- RBI’s Policy Outlook

- Current inflation levels are unlikely to alter the RBI’s stance on interest rates.

- With GDP growth on track, the central bank will likely maintain its policy rates in the upcoming meeting (September 29 – October 1, 2025).

- So far in 2025, the RBI has already cut rates by 100 basis points to support growth, and in August, it projected inflation at 3.1% for the fiscal year.

- Global Economic Perspective

- Hanna Luchnikava-Schorsch, Head of Asia-Pacific Economics at S&P Global Market Intelligence, said inflation may rise modestly in the months ahead.

- Still, the GST cuts should slow this increase, helping keep CPI inflation near the RBI’s 4% target midpoint through the end of 2025.

- S&P now forecasts 3.3% average inflation for FY26, lower than its earlier estimate of 3.5% before the GST reform.

Final Thoughts

The 2025 GST rate cuts are a big step toward keeping prices stable. With inflation already low, these changes could bring further relief from October. But the outcome will depend on whether businesses pass savings to consumers, global and food prices remain stable, and the government manages its finances effectively.