Public Sector Undertaking (PSU) banks have long played a central role in India’s financial system. In 2025, they continue to attract attention amid market rallies, ongoing volatility, policy changes, and rising investor interest.

In this blog, we will try to explain what PSU bank stocks are, their major benefits, and how they are currently performing in today’s market landscape.

What are PSU Bank Stocks?

“PSU bank stocks” are the shares of banks in which the Government of India holds a majority stake—commonly known as Public Sector Banks (PSBs). These institutions are collectively referred to as PSU banks.

Some well-known PSU banks include:

- State Bank of India (SBI)

- Bank of Baroda

- Punjab National Bank (PNB)

- Canara Bank

- Union Bank of India

PSU banks had been performing well for some time. They improved their loan quality, reduced bad loans (NPAs), and benefited from government reforms and mergers. Because of these positives, investor confidence increased. As a result, the PSU Bank Index — like the Nifty PSU Bank Index — often did better than many private banks during strong market phases.

Overview of PSU Bank Stocks in 2025

The year 2025 has been eventful for PSU banks, with a mix of recovery, rising valuations, and some short-term market pullbacks. Several key trends are shaping the sector:

a) Major Reduction in NPAs

Over the past few years, PSU banks have significantly cut down their bad loans. Better provisioning, recoveries through the Insolvency and Bankruptcy Code (IBC), and stronger lending practices have improved overall asset quality.

b) Gains from Bank Mergers

The earlier mergers among PSU banks are now paying off. They’ve led to lower costs, better use of branches, and smoother operations.

c) Loan Growth from India’s Infrastructure Push

With India continuing to invest heavily in infrastructure, manufacturing, and capital expenditure, credit demand has increased — areas where PSU banks have a strong presence.

d) Stronger Profitability

Many PSU banks are now reporting higher profits, better loan growth, and strong margins thanks to fewer loan defaults and increased lending activity.

e) More Focus on Retail Loans

PSU banks are gradually expanding in retail lending — such as home loans, personal loans, and MSME loans — which helps diversify their portfolio and reduce their earlier dependence on large corporate loans.

Advantages of Investing in PSU Bank Stocks

These are some of the main reasons why PSU bank stocks have attracted investors both in the past and even today:

Improved Loan Quality – In recent years, PSU banks have managed to bring down their bad loans and NPAs by cleaning up their books and transferring stressed assets to reconstruction platforms.

Attractive Valuations Compared to Private Banks – PSU banks are often priced lower than private banks in terms of P/B (price-to-book) or P/E (price-to-earnings) ratios, which makes them look undervalued or like strong “value picks.”

Support from Government Policies and Reforms – Government measures such as reforms, capital infusion, mergers, and stronger governance have strengthened confidence in PSU banks and boosted expectations of long-term improvement.

Scope for Institutional & Foreign Investment – Because of their reasonable valuations and ongoing reforms, PSU banks often attract interest from large institutional investors and foreign investors (FIIs), which can push stock prices higher.

Stability Due to Government Ownership – Since these banks are majority-owned by the government, they are seen as more stable—especially during uncertain or volatile times.

Current Scenario of PSU Bank Stocks in India (2025–2026)

After going through a volatile phase, PSU bank stocks have once again become popular among investors. The Nifty PSU Bank Index, which had earlier seen big ups and downs, made a strong comeback with a solid rally in late 2025 as investors shifted their attention back to public-sector banks.

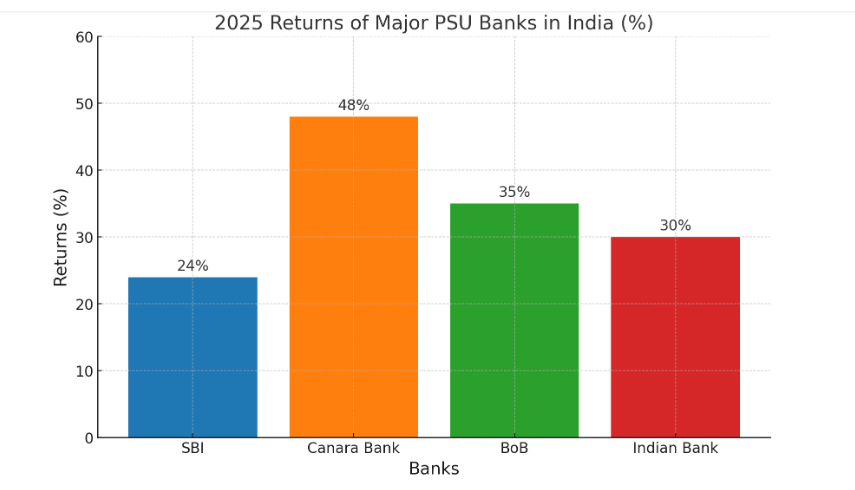

During this time, several leading PSU banks posted strong returns. State Bank of India (SBI) gained around 24%, Canara Bank jumped nearly 48%, and Bank of Baroda and Indian Bank also delivered good growth. This strong performance across major players showed that confidence in the sector’s future was improving. (Source: Mint)

The recent earnings performance has further supported this positive view. In Q2 FY26, PSU banks together reported a 4.7% rise in net profit compared to last year, while many private banks saw their profits decline. This improvement came from higher fee income, better treasury gains, and steady growth in retail and MSME lending. (Source: Moneycontrol)

Looking ahead, analysts and brokerages remain cautiously optimistic. Many believe PSU banks could still see more gains if economic pressures are reduced. Possible interest-rate cuts and improving economic signals may also help push the sector forward. (Source: The Economic Times)

Detailed Data Representation through Graph

SBI: ~24%

Canara Bank: ~48%

Bank of Baroda (BoB): ~35% (approximate)

Indian Bank: ~30% (approximate)

This graph visually reflects the strong performance of Canara Bank and solid gains for the other major PSU banks.

What does this mean for PSU Stock Investors?

The recent decline shows that policy announcements and regulatory decisions can influence PSU bank stocks more strongly than their financial performance alone.

For long-term investors:

PSU banks can still be attractive if their asset quality stays healthy, valuations remain reasonable, and reforms move forward. Keep an eye on improving profitability, policy clarity, and supportive regulatory changes.

For short-term traders:

Expect sharp price movements. PSU bank stocks can react quickly to updates related to FDI norms, RBI regulations, or broader economic news.

Conclusion

PSU bank stocks in 2025 stand at an important phase of transition. Once burdened by high NPAs and legacy issues, these banks have reshaped themselves into stronger, more efficient, and more profitable institutions. Although challenges remain—such as rising competition and ongoing regulatory pressures—the long-term outlook for the sector is still positive.

For investors, PSU banks provide a mix of attractive valuations, the reassurance of government support, and exposure to India’s broader economic expansion. While short-term fluctuations are likely, the underlying structural upgrades make this segment worth monitoring closely.